Mar 12, 2014

Cook County house prices up more than 15 percent, pace of recovery varies by neighborhood

Cook County house prices up more than 15 percent, pace of recovery varies by neighborhood

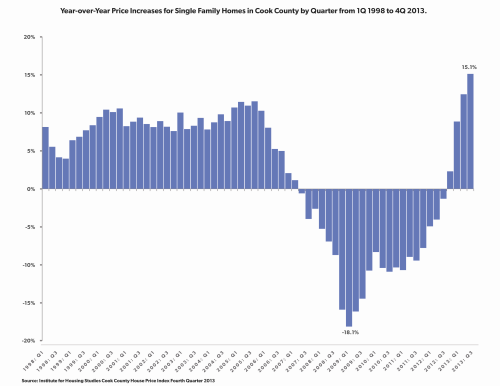

CHICAGO — Home prices in the fourth quarter of 2013 in Cook County were up 15.1 percent year over year, their largest increase in 16 years, according to the March 12 release of the Cook County House Price Index from the Institute for Housing Studies at DePaul University.

The report finds price recovery in 2013 varied throughout Cook County submarkets, with the largest year-over-year price increases found in submarkets such as Jefferson Park/Edison Park, Irving Park/Albany Park and Portage Park/Belmont Cragin. All saw year-over-year price increases above 20 percent. Despite recent increases, however, house prices in these markets are all far from peak levels experienced during the housing boom, with Irving Park/Albany Park just over 19 percent below peak prices, and Portage Park/Belmont Cragin almost 43 percent off of its housing bubble peak.

The index also finds a core group of submarkets remained relatively stable throughout the housing crisis and are now less than 20 percent off their price peak level. These submarkets include Lincoln Park/Lakeview, West Town/Logan Square, Lincoln Square/North Center and Uptown/Rogers Park.

The report found that among these markets Lincoln Park/Lakeview is the only Cook County submarket that has exceeded its highest price level of the housing boom, with prices in the fourth quarter of 2013 at 4.5 percent higher than their previous high point, reached in the third quarter of 2007.

Finally, the data also show a group of submarkets experiencing weak price recovery or, in some cases, still experiencing price declines. Submarkets with year-over-year price increases of less than 2 percent are suburban Oak Forest/Midlothian and Chicago Heights/Matteson. City of Chicago submarkets with price declines included Roseland/South Chicago and Pilsen/Bridgeport. All of these submarkets are at price levels between 46 and 67 percent off peak levels.

“The County’s housing market continues to see substantial improvements,” said Geoff Smith, executive director of the Institute for Housing Studies. “However, the most dramatic price gains were isolated in a small group of submarkets that are rebounding from large price declines during the housing crisis. It will be important to track whether recent price growth in these areas will translate to long-term price stability.”

Other findings from the Index:

• House prices in Cook County are now comparable to levels seen in the second quarter of 2002 and are just over 31 percent off their peak levels reached during the housing bubble.

• The fourth quarter of 2013 marked the fifth consecutive quarter with price increases for all of Cook County.

• The last two quarters of 2013 had the weakest price increases of the year, with prices in Cook County rising 2.7 percent from the second to third quarter and 2.5 percent from third to the fourth quarter — an indication that price recovery may be slowing.

The Institute for Housing Studies is a research center based at DePaul University that provides analysis and data to inform affordable housing policy and practice. The institute’s fourth quarter 2013 House Price Index tracks quarterly price changes for single family properties in Cook County with repeat sales from the first quarter of 1997 through the fourth quarter of 2013. The report is at http://bit.ly/1ivBhuZ.

###

MEDIA CONTACT:

Tina Fassett

kfassett@depaul.edu

312-362-5974

Cook County house prices up more than 15 percent, pace of recovery varies by neighborhood. (Graphic by IHS)

Cook County house prices up more than 15 percent, pace of recovery varies by neighborhood. (Graphic by IHS)

Home prices in the fourth quarter of 2013 in Cook County were up 15.1 percent year over year, their largest increase in 16 years, according to the March 12 release of the Cook County House Price Index from the Institute for Housing Studies at DePaul University. (Photo by Jeff Carrion)