May 06, 2013

Many consumers still not reading mortgage fine print: DePaul and John Marshall study

Many consumers still not reading mortgage fine print: DePaul and John Marshall study

CHICAGO – The housing bubble that led to the nation’s economic crisis was greatly inflated by millions of home buyers signing onto oversized mortgages that they had not carefully read, did not fully understand and could not really afford. Congress responded by mandating improved home loan disclosure forms.

In the wake of this mandate, one might think that anyone putting their financial lives on the line is now carefully reading and fully comprehending loan terms before signing their financial futures away. Perhaps not, according to a first-of-its-kind study by Jessica Choplin, associate professor of psychology at DePaul University, and Debra Pogrund Stark, professor of law at The John Marshall Law School in Chicago.

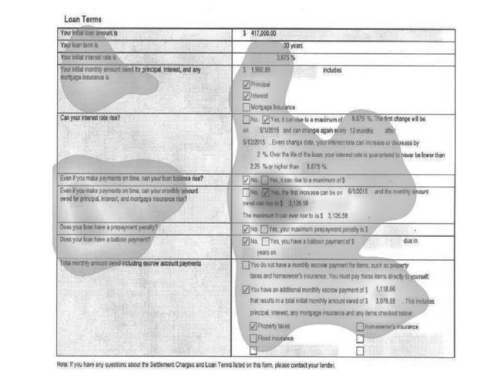

Utilizing visual sensory technology to track eye movement, Choplin and Stark’s research found that study participants often failed to note that the loan’s interest rate and monthly payment would rise. Participants in the three-year study were first verbally informed of either the initial interest rate or initial monthly payment and then instructed to review the disclosure form to prepare to answer questions about the loan. Although the disclosure form used prior to lending reforms included a sentence identifying the loan as having an adjustable rate, 31 percent failed to look at this information. Instead they skimmed the form looking for confirmation of what they had been told and then ceased to look further.

Choplin and Stark then conducted the same experiment but with the improved home loan disclosure forms that better highlight the adjustable rate features of the loan. Participants who were presented with the improved home loan disclosures were more likely to see that the interest rate and monthly payments could increase. But 19 percent still failed to notice that the loan had adjustable rate features. This result shows that improved disclosure forms can lead to better-informed decision-making.

However, Choplin and Stark ran a third test, in which the new forms were used but distractions were created as the study participant reviewed the document. The distractions led to 45 percent of participants failing to comprehend the loan they were reviewing had an adjustable rate, more than double the rate for the non-distracted participants.

“While a great deal of effort by the federal government has been put into reforming and improving home loan documents, many of the underlying problems that led to the mortgage and real estate crisis appear to persist,” said Choplin, who co-authored the study with Stark and Mark A. Leboeuf, a DePaul graduate student in psychology.

“Even with improved forms, if the borrower is distracted by conversation they can fall prey to interjected distractions,” Stark said. “All it takes is someone asking a question or making a comment not related to the document and the borrower can miss important information. These types of distractions routinely occur at closings,” noted Stark, who practiced real estate law prior to her academic career.

The studies are part of a larger project funded by the National Science Foundation examining how consumers review and process information in home loan disclosure documents. Choplin and Stark have written 10 papers since 2007 on issues relating to consumer fraud.

“I believe the study suggests that more targeted counseling is needed to make sure that consumers understand how their mortgages fit into their larger financial goals,” Choplin said.

“Making the forms easier to understand and better disclosing problematic loan features is essential, but so is requiring an unbiased expert such as an attorney or mortgage lender who possesses the relevant background knowledge to assist the borrower in making a wise home loan decision,” Stark stresses. “Even when borrowers noticed that the loan contained adjustable rate features when rating the desirability of the loan, many failed to note how that could lead a borrower to not be able to afford the loan in the future, a point that an unbiased expert would highlight.”

The studies appear in the current issue of the Yale Law Journal Online and can be found at http://bit.ly/15dzpDT.

About DePaul University

With approximately 25,000 students, DePaul is the largest Catholic university in the United States and the largest private, nonprofit university in the Midwest. The university offers approximately 275 graduate and undergraduate programs of study on three Chicago and two suburban campuses. Founded in 1898, DePaul remains committed to providing a quality education through personal attention to students from a wide range of backgrounds. For more information, visit www.depaul.edu.

About The John Marshall Law School

The John Marshall Law School, founded in 1899, is an independent law school located in the heart of Chicago’s legal, financial and commercial districts. Through classes, clinics and special programs, students develop the strategic, analytical and transactional lawyering skills that are so valuable to employers. Its excellent curriculum, coupled with outstanding skills and experiential learning, help make John Marshall graduates practice-ready from day one. For practicing attorneys, John Marshall offers nine LLM degrees, more than any other law school in the Midwest. John Marshall is also a leader in providing distance education options in intellectual property, estate planning and employee benefits at the advanced graduate degree level. John Marshall offers six clinical experiences, including the nationally recognized Veterans Legal Support Center & Clinic and the Fair Housing Legal Clinic. U.S. News & World Report’s America’s Best Graduate Schools 2014 edition ranks John Marshall’s Lawyering Skills Program second and its Intellectual Property Law program 12th in the nation. For more information, visit www.jmls.edu.

Media Contacts:

John Holden

DePaul University

312/362-7165 or jholden2@depaul.edu

Or

Christine Saba

Christine Saba Public Relations on behalf of The John Marshall Law School

630/971-8065 or cesaba@aol.com

Using eye-tracking technology, a study by professors at DePaul University and John Marshall Law School show how many study participants fail to grasp key terms of mortgage contracts. The darker the area, the more time the study participant spent looking at various areas of the contract.